investor zone

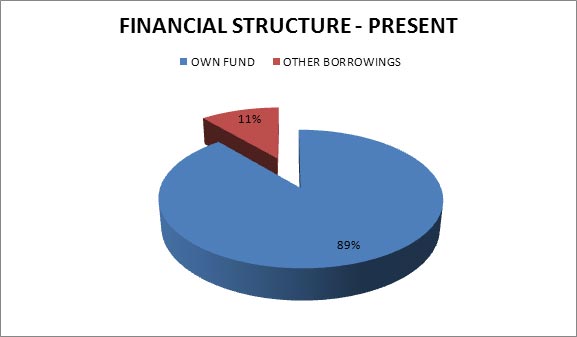

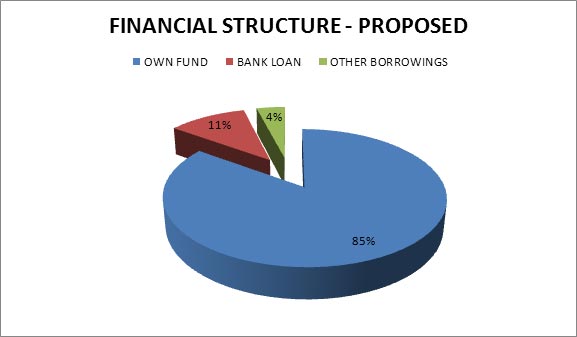

FINANCIAL STRUCUTRE - pre & post expansion

In view of the growth prospects of the company and its future plans to tap into new markets as well as products, the capital structure of the company was revamped in the previous year whereas the authorized capital was increased from Rs. 8 crores to Rs. 20 crores.

The present financial structure of the company comprises of its own capital and other corporate and non corporate borrowings.

The company now plans to diversify its capital structure by availing of bank finance and reducing its exposure to inter corporate and other borrowings.

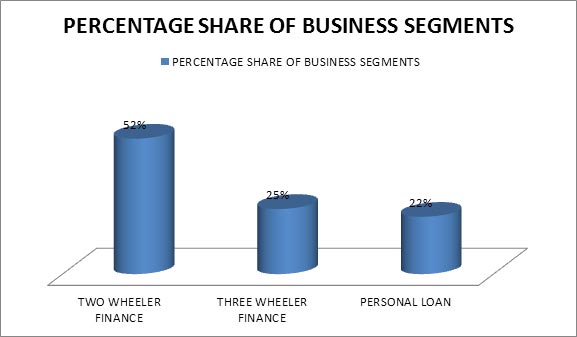

MARKETS BASE

The company presently is operating, through various dealers, in almost all the areas of Delhi. It has a fair amount of chunk in the vehicle finance business in Faridabad and Ghaziabad areas. The current market base of the company may be divided into the following business segments:

- Two wheeler finance

- Three wheeler finance

- Personal loans

In the year 2013-14, the amount financed under different business segments was as follows:

| Type |

Amt. in lacs |

No. of cases |

| Two Wheeler Loans |

1417.11 lacs |

3627 cases |

| Three Wheelers Loans |

666.00 lacs |

538 cases |

| Personal Loans |

603.96 lacs |

335 cases |

| TOTAL |

2687.09 lacs |

4500 cases |

(based on the year 2013-14 data)

For future plans, the company proposes to enhance its reach into vehicle finance by including four wheelers as well. In addition, it also has plans to venture into gold loan market.